Winning the lottery is a fantasy of every lottery player. The promise of life-changing jackpots becomes a reality, transforming the player into a millionaire. All lotteries come with their advertised jackpots that the winner gets when they match all the winning numbers in the draw. However, the winner does not take the entire jackpot home in all cases. For starters, they have to pay tax on lottery winnings. They may also have to share the winnings if more than one person predicts the winning combination.

There is a comprehensive list of reasons that may cause some of your lottery winnings to be taken. In this article, we will explain some of the situations that can cause it. This guide also contains tips to protect your lottery winnings.

Contents

Situations Where Some of Your Lottery Winnings May be Taken

Here are some situations where some of your lottery winnings may be taken.

Taxes on Lottery Winnings

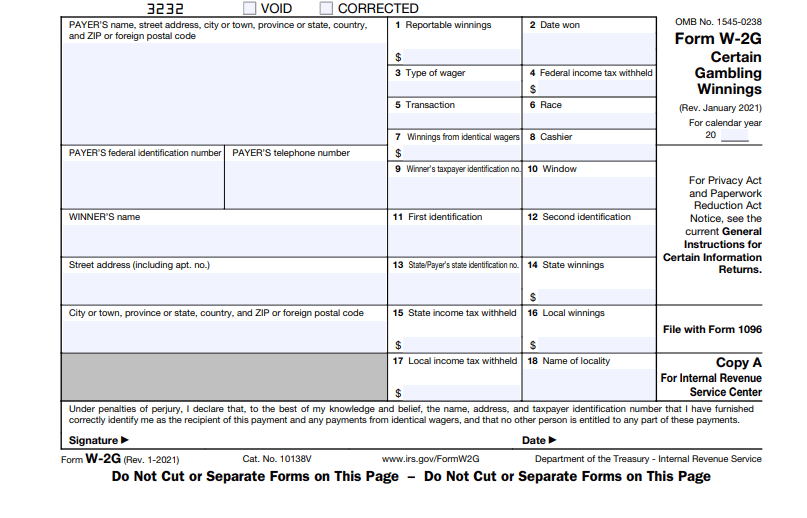

Most lotteries have tax charges on lottery winnings set by the government. The tax charges may come from either the federal or state government, or both. For instance, Powerball and Mega Millions winners must pay federal and state taxes on lottery winnings. It is crucial to understand the tax charges for lottery wins so you would know how to report your winnings in the Form W-2G. To know how much tax to pay, we recommend you use our Powerball tax calculator or Mega Millions tax calculator.

Source: Internal Revenue Service

It also depends on the country where you play.

The table below shows the federal lottery taxes in different countries.

| Country | Federal Lottery Tax |

|---|---|

| United States of America | 37% |

| United Kingdom | Tax-free |

| Canada | Tax-free |

| Spain | 20% |

| Italy | 20% |

| Switzerland | 35% |

| Portugal | 20% |

| Belgium | Tax-free |

| France | Tax-free |

| Austria | Tax-free |

| Australia | Tax-free |

Debt Judgements and Enforcement Orders

If you owe money or are in debt, you may be forced to pay what you owe immediately. The creditor can open a debt collection case to seek a debt judgment in court. Suppose the court rules that the lottery winner indeed owes money. In that case, the creditor can collect an enforcement order to mandate the lottery organizers to pay the creditor from the winnings. Debt judgments also apply to other debts, such as unpaid taxes, child support, or legal judgments.

Also, if you win while in bankruptcy, you must list the winnings in the bankruptcy schedules. You will get the remaining amount after all the bankruptcy costs are paid. But if you bought the ticket before filing for bankruptcy, you may be able to keep your entire lottery winnings.

Splitting Lottery Winnings

Sometimes, more than one winner matches the winning combination in the draw. When this happens, the lottery organizers will split the winnings equally between the lottery winners. For example, if the jackpot is $100 million and there are four winners, each winner will receive $25 million.

Unpaid Government Obligation

Your lottery winnings can be withheld or reduced if you owe money to the government, such as unpaid student loans, government loans, or tax debts. You may also face deductions or total seizure if you owe unpaid fines and penalties, such as traffic violations or criminal restitution. The government can intercept your lottery winnings to settle outstanding fines and penalties.

What Can Disqualify You from Winning the Lottery

The lottery has certain rules and regulations that all players who participate in the game must follow. Failure to comply with these rules can disqualify you from winning the lottery. You will not be paid the jackpot even if you match all winning numbers. Here are some things that can qualify you to win the lottery.

#1. Age Restrictions

All lotteries have minimum age restrictions for players. For most lotteries, the age restriction is 18 years. Although, how old you have to be depends on the country of residence. If you play the lottery while below the legal age, you will be disqualified from winning even if you match all the winning numbers.

Lottery organizers usually perform an extensive background check on lottery winners before paying out winnings to ensure they satisfy the age requirement. So there is no way to avoid this rule.

#2. Ineligible Ticket Purchase

This is a situation when a person buys a ticket in a manner that violates the rules of the lottery. For instance, there may be geographical restrictions on certain lottery games. An example is the United States. Certain states such as Alabama, Alaska, Nevada, Utah, and Hawaii do not sell lottery tickets, so tickets may be considered ineligible in such areas except to buy outside these states.

Here are some of the best options to play online are listed in the table below.

#3. Failure to Submit Necessary Documentation

Before the lottery organizer pays lottery winnings, they perform checks to be sure that players comply with the terms and conditions of the location. They do this by demanding identity documentation such as ID cards, international passports, and driver’s licenses. If you cannot tender your identification document, you will have to forfeit your prize.

How to Protect Your Lottery Winnings

Winning the lottery will change your life. It can help you to pursue your dreams and live comfortable lives. You can even decide to stop working forever. However, there are some things to do if you win the lottery. These steps can help ensure long-term security and proper financial management of your newfound wealth.

Here are some tips to protect your lottery winnings:

#1. Seek Professional Advice

Let’s be realistic. Becoming a millionaire overnight can be overwhelming. If you aren’t careful, you may spend it wrongly and go back to square one. There are many stories of lottery winners, such as Stefan Mandel, who invested wisely and lived comfortably for the rest of their lives. On the contrary, others like Marie Holmes squandered their winnings and lost it all.

While it might be enticing to spend like the millionaire you are now. It is wise to exercise a bit of restraint while spending. Consider hiring the services of financial accountants and lawyers to help you make wise financial decisions; This will help you make the best of your winnings.

#2. Stay Anonymous

Check if the lottery organizers can permit you to remain anonymous. Winning the lottery will attract all sorts of attention to you. Friends, families, and even strangers will want to relate with you to see if you will be willing to share your winnings. Media houses and reporters will also want to interview and put you on the news. Staying anonymous allows you to escape all unwanted attention. Nobody will know your identity, so they won’t be able to contact you.

#3. Decide Whether to Take Lump Sum or Annuity

Some lotteries allow you to choose whether you have your entire winnings at once or in installmental payments over several years. We recommend you think about it, depending on your plans for your money. Consider the pros and cons of lump sum vs annuity to help you make the best decisions for you.

#4. Create a Financial Plan

We recommend you create a financial plan before the money lands in your account. Develop a comprehensive financial plan outlining your short-term and long-term goals for winnings. This will help you to effectively manage your winnings while protecting from mismanagement and impulsive decisions.

#5. Set up a Lottery Trust

You could also establish a trust to offer anonymity while claiming your winnings. However, it requires a lot of paperwork, so you might need to hire a professional lawyer or financial adviser specializing in trusts and estate planning. They will guide you through the process of setting up a lottery trust.

FAQs

How can I share my lottery winnings with my family?

Yes, you can share your lottery winnings with your family. You could invest in their education, set up a business for them, or just give them cash gifts. You can spend your winnings as you like.

Do I have to share my lottery winnings with my spouse or ex-spouse?

You can choose to share your lottery winnings with your spouse or ex-spouse. Winners can spend their winnings as they deem fit.

Can lottery winnings be donated to charity?

Yes, you can donate your lottery winnings to charity. You can make a donation to any charity of your choice. Or better yet, you could establish your own charitable trust to support charitable initiatives that you are passionate about.

Can the government take your lottery winnings?

Yes, the government can take your lottery winnings. For instance, your lottery winnings may be taxed by the government. The government may also seize your earnings if you owe unpaid taxes, child support, or government loans.

Can creditors take your lottery winnings?

Yes, creditors can take your lottery. Once your creditor knows that you are winning the lottery, they can open a debt collection case against you in court. If the court rules in their favor, you will have to pay what you owe.

Can my lottery winnings be garnished?

Yes, your lottery winning can be garnished if you have debts prior to winning the lottery. Debts like unpaid taxes, unpaid child support, defaulted loans, and fines and penalties.

For what reasons can a mass lottery hold or take your winnings?

Your winnings can be withheld or taken if you fail to comply with the terms and conditions of the lottery. It may also be withheld if there are legal disputes concerning your ticket entry.

Can lottery winnings be seized by the police?

No, your lottery winnings cannot be seized by the police. Although particular situations may cause the police to seize your winnings. For instance, if your lottery winnings are suspected to be connected to criminal activities, the police may seize your fund as part of the investigation.

Can lottery winnings be taken if you are on public assistance?

No, your lottery winnings cannot be taken if you are on public assistance. Although winning the lottery may affect your eligibility for public assistance, depending on the specific rules of the place you reside.

![Taxes on Lottery Winnings Explained [year] Taxes on lottery winnings](https://lotteryngo.com/wp-content/uploads/2024/01/Taxes-on-lottery-winnings-300x157.jpg)